Get Ahead With A Taxes API: Valid For The U.S.A

Do you need to get ahead with a tax API? If so, you'll want to use the following API.

As you may know, taxes are owed to the government regularly. However, it can be challenging to keep track of all tax obligations and due dates. Many companies do this by spending a lot of time and money researching taxes in each location. Being able to see which ones are needed and how much they cost is a time-consuming task. That is why many people use Tax APIs to automate the tax process.

A tax API is a software application that allows developers to access and integrate tax information into their applications. It allows users to request and receive tax data from the government in a user-friendly way.

Anyone who needs access to tax information can use a tax API. This includes individuals, companies, and governments. Developers use tax APIs to build apps that help people manage their taxes; track their spending; and find deductions to save money on taxes.

A tax API is a software application that allows developers to access and integrate tax information into their applications. It allows users to request and receive tax data from the government in a user-friendly way.

Anyone who needs access to tax information can use a tax API. This includes individuals, companies, and governments. Developers use tax APIs to build apps that help people manage their taxes; track their spending; and find deductions to save money on taxes.

Benefits of using a tax API

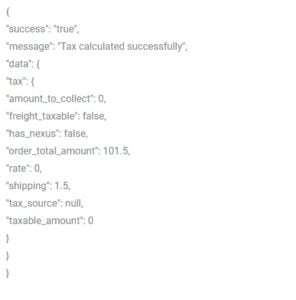

There are many benefits to using a tax API. One benefit is that it can save you time and effort by automatically calculating your taxes for you. This can save you from having to figure out your taxes yourself, which can be a time-consuming process. Another benefit of using a tax API is that it can help you avoid making mistakes when calculating your taxes. This is because taxes can be a complicated subject and mistakes can result in penalties or fines from the government. By using an API, you can avoid these errors entirely. So if you need to move forward with a tax API, we recommend using the TaxesAPI. This is an easy-to-use API that allows you to access all the data needed for your taxes with just a few clicks. Plus, TaxesAPI is constantly updated with the latest tax information, so you'll always have the most up-to-date data available. To get ahead with TaxAPI, follow these simple steps: - Go to the Zyla API HUB where you will see a box asking for your API Key. -In the "Verify your humanity" box, enter your social security number or ITIN. - That's all! The rest of the information will be displayed on this page. So, what are you waiting for? Start getting ahead with TaxesAPI now!